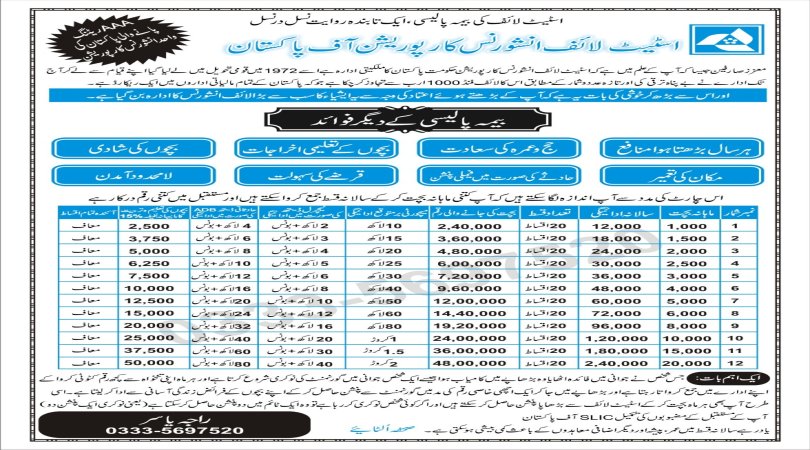

Endowment Assurance Policy

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

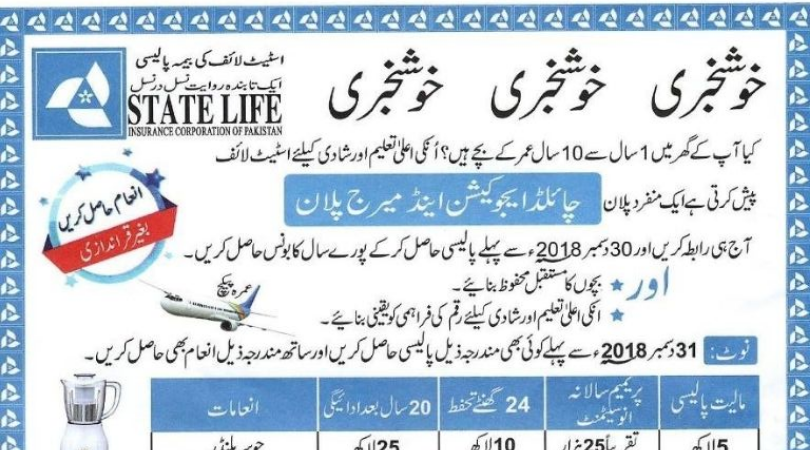

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

An endowment assurance policy is a type of life insurance policy that provides both a life insurance component and a savings or investment component. It is designed to provide financial protection to the policyholder's beneficiaries in the event of the policyholder's death while also building cash value over a specified period.

Here are the key features of an endowment assurance policy:

1.Death Benefit:

The primary purpose of an endowment policy is to provide a death benefit to the beneficiaries of the policyholder. In the event of the policyholder's death during the policy term, a lump sum amount, known as the death benefit, is paid out to the designated beneficiaries. This amount is typically tax-free.

2.Maturity Benefit:

Unlike term life insurance policies, endowment assurance policies also offer a maturity benefit. If the policyholder survives the entire policy term, they receive a lump sum amount called the maturity benefit. This amount includes the sum assured (the initial coverage amount) plus any bonuses or returns earned on the policy's investments.

3.Premium Payments:

Policyholders are required to pay regular premiums to keep the policy in force. These premiums can be paid annually, semi-annually, quarterly, or monthly, depending on the policy terms and the insurance company's policies.

4.Savings and Investment Component:

A portion of the premium paid by the policyholder is invested by the insurance company. The returns on these investments, along with any bonuses declared by the insurer, contribute to the maturity benefit. Over time, the policy builds a cash value, which policyholders can often access through loans or withdrawals.

5.Fixed Term:

Endowment assurance policies have a fixed policy term, which can range from 10 to 30 years or more. The policyholder chooses the term at the time of purchase.

6.Surrender Value:

If the policyholder decides to terminate the policy before maturity, they can usually surrender it to the insurance company and receive a surrender value, which is a portion of the accumulated cash value. However, surrendering the policy early may result in a reduced payout compared to the maturity benefit.

7.Bonuses:

Some endowment policies offer annual or terminal bonuses, which are declared by the insurance company based on the performance of their investments and financial stability. These bonuses are added to the maturity benefit and can enhance the overall returns of the policy.

Endowment assurance policies are often marketed as a combination of insurance and savings, making them appealing to individuals who want to provide financial security for their loved ones while also building a nest egg for future needs. However, they tend to have higher premiums compared to pure term life insurance policies, and the returns on the savings component may not always outperform other investment options, such as mutual funds or stocks. Therefore, individuals should carefully assess their financial goals and needs before purchasing an endowment assurance policy.

People who live outside the country can also contact 0092-333-5697520