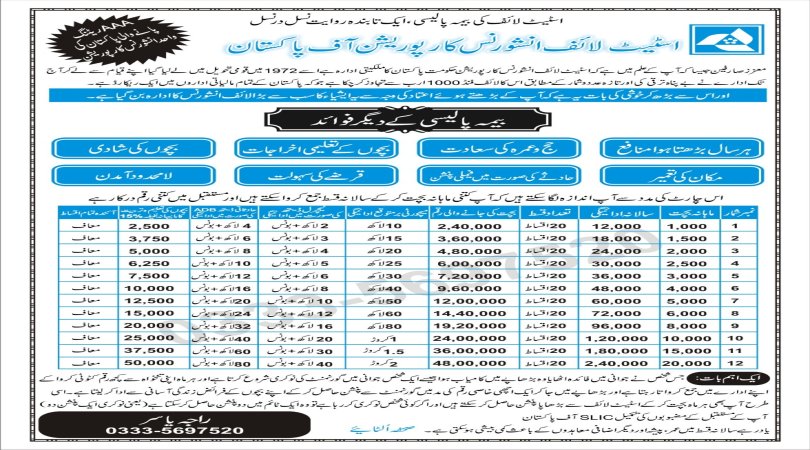

Mahana Profet and Policy Hasel Karen Sirf Ek Fone Call Per

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

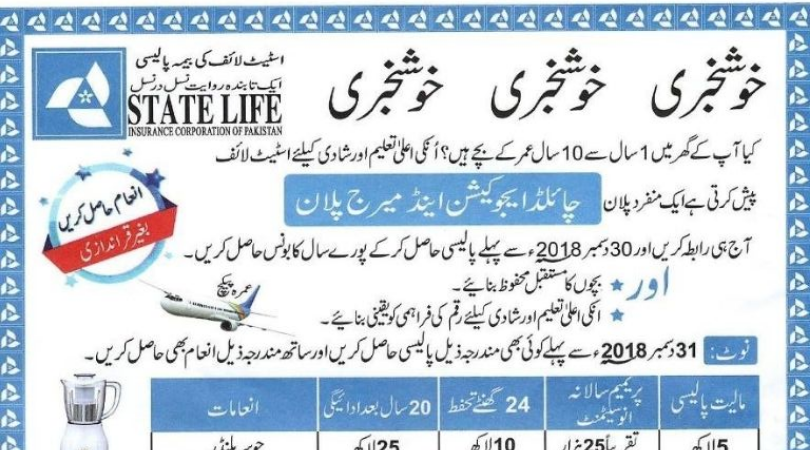

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

Anticipated Endowment Assurance is a type of life insurance policy that combines elements of both endowment insurance and whole life insurance. This insurance product is typically offered by life insurance companies and is designed to provide a combination of death benefit and savings or investment components.

Here are some key features of Anticipated Endowment Assurance:

1.Guaranteed Payout:

With this type of policy, the insured person is guaranteed to receive a lump sum payout at the end of a specified term or upon their death, whichever occurs earlier. This lump sum is known as the "sum assured" or "face amount" of the policy.

2.Maturity Benefit:

Unlike pure term life insurance, where there is no maturity benefit if the insured person survives the policy term, Anticipated Endowment Assurance policies provide a maturity benefit even if the insured survives the policy term. This maturity benefit can be used as a savings or investment tool.

3.Periodic Payouts:

In addition to the maturity benefit, these policies often provide periodic payouts during the policy term. These payouts are typically made at regular intervals (e.g., annually) and can be used to meet financial goals or expenses during the policy's tenure.

4.Premium Payments:

Policyholders are required to pay regular premiums throughout the policy term to keep the policy in force. These premiums cover the cost of insurance, administrative expenses, and contribute to the savings or investment component of the policy.

5.Savings/Investment Component: A portion of the premium payments is invested by the insurance company on behalf of the policyholder. This investment component accumulates over time and contributes to the overall maturity benefit and periodic payouts.

6.Flexibility:

Anticipated Endowment Assurance policies may offer flexibility in terms of premium payment frequency, policy term, and coverage amount, allowing policyholders to tailor the policy to their financial needs and objectives.

7.Tax Benefits:

Depending on the tax laws in the policyholder's country, the premiums paid and benefits received under an Anticipated Endowment Assurance policy may be eligible for tax benefits.

It's important to note that the specific features and benefits of Anticipated Endowment Assurance policies can vary from one insurance company to another and may also depend on the terms and conditions outlined in the policy contract. Before purchasing such a policy, it's advisable to carefully review the policy documents, understand the terms, and consult with a financial advisor to ensure that it aligns with your financial goals and needs.

People who live outside the country can also contact 0092-333-5697520