Health Insurance

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

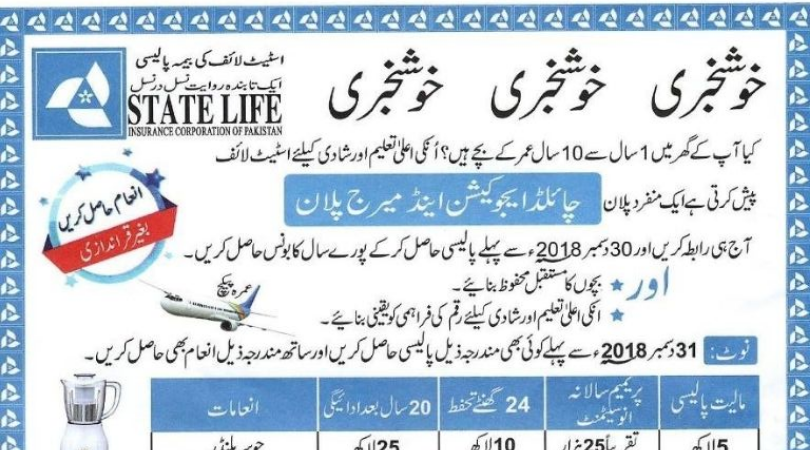

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

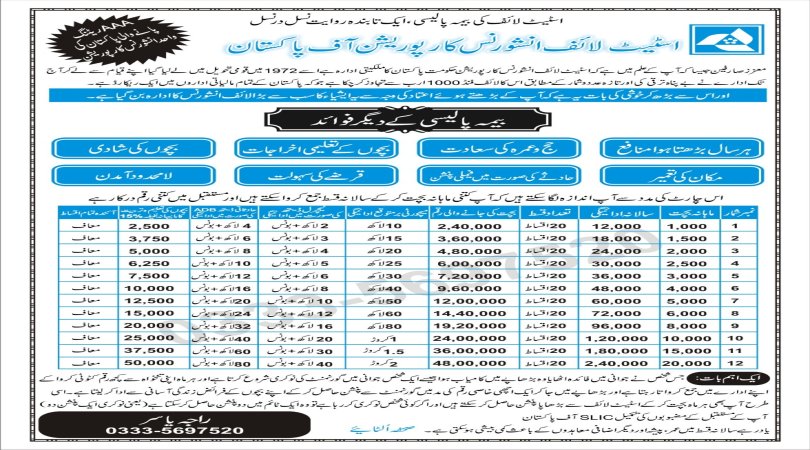

- Committee Policy

Health Insurance In exchange for regular premium payments, the insurance company agrees to cover a portion of the individual's healthcare expenses.

1.Premium:

This is the amount you pay to the insurance company on a regular basis, typically monthly. It's a kind of membership fee for your insurance coverage.

2.Deductible:

The deductible is the amount you must pay out of pocket for covered medical expenses before your insurance plan starts to pay. For example, if you have a $1,000 deductible, you'll have to pay the first $1,000 of covered medical expenses before your insurance kicks in.

3.Co-payments and Co-insurance:

These are the portions of the medical expenses that you are responsible for after you've met your deductible. Co-payments are fixed amounts (e.g., $20 for a doctor's visit), while co-insurance is a percentage of the cost of the service (e.g., you might pay 20% of the cost of a hospital stay).

4.In-network vs. Out-of-network:

Many insurance plans have a network of preferred providers (doctors, hospitals, clinics) with whom they have negotiated lower rates. Staying in-network is usually less expensive for the insured individual.

5.Coverage:

Health insurance plans vary in terms of what they cover. Basic plans typically cover doctor's visits, hospital stays, and prescription drugs. Some plans also cover specialized services like mental health care, maternity care, and preventive care.

6.Preventive Care:

Many health insurance plans cover preventive services like vaccinations, screenings, and wellness check-ups at no cost to the insured individual. This is because preventive care can help catch and treat health issues early, which can ultimately save money for the insurance company and improve your health.

7.Open Enrollment:

Health insurance plans are often available through employer-sponsored programs, government programs like Medicare or Medicaid, or through private marketplaces. There are specific enrollment periods during which you can sign up for or change your health insurance plan. Open enrollment periods can vary by employer and by the type of plan.

8.Emergency Coverage:

Health insurance plans typically cover emergency medical services, even if they are provided by out-of-network providers. This ensures that you can receive necessary care in emergencies without worrying about whether the provider is in-network.

9.Mental Health Coverage:

Many health insurance plans now include mental health and substance abuse treatment as essential benefits. This reflects a growing recognition of the importance of mental health care.

10.Laws and Regulations:

Health insurance is subject to various laws and regulations that vary by country. For example, in the United States, the Affordable Care Act (ACA) established regulations regarding health insurance coverage, including protections for pre-existing conditions and requirements for essential health benefits.

It's important to carefully review and compare health insurance plans to find one that suits your needs and budget. Understanding the terms and coverage of your plan is essential to make the most of your health insurance benefits and ensure you receive the necessary medical care when you need it.

People who live outside the country can also contact 0092-333-5697520