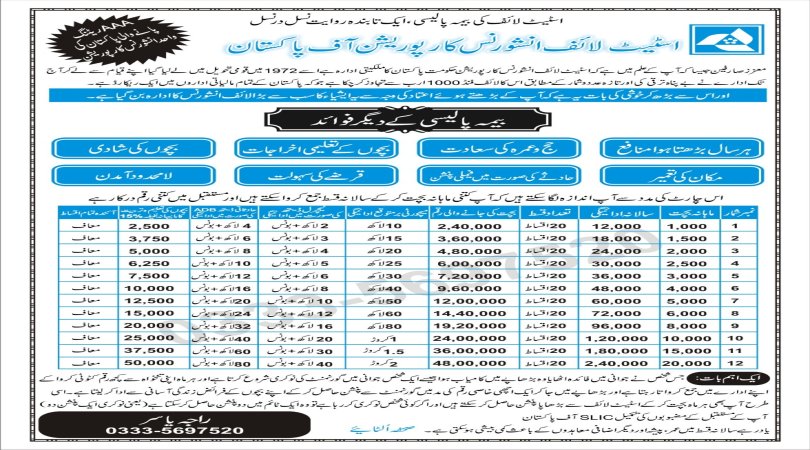

State Life Supplementary Covers insurance Policy

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

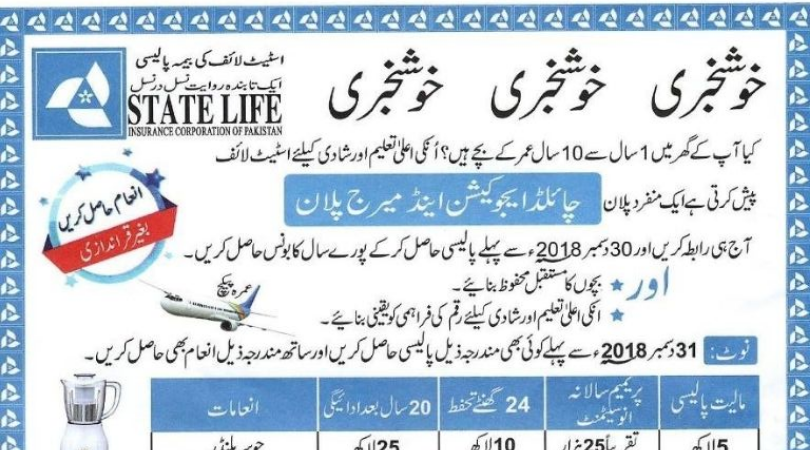

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

State Life Supplementary Covers insurance policy refers to additional coverage options or riders that can be added to a primary life insurance policy offered by State Life Insurance Corporation of Pakistan or a similar insurance provider. These supplementary covers are designed to enhance the basic coverage provided by the primary life insurance policy and can be customized to meet the policyholder's specific needs and financial goals. Here are some common supplementary covers or riders that can be added to a State Life Insurance policy or a similar policy:

1.Accidental Death and Dismemberment Rider (AD&D):

This rider provides an additional benefit in case the policyholder dies or suffers from specific injuries due to an accident. It typically pays out a lump sum amount in addition to the base life insurance coverage.

2.Critical Illness Rider:

This rider offers coverage in case the policyholder is diagnosed with a critical illness such as cancer, heart attack, or stroke. It provides a lump sum benefit to help cover medical expenses and other financial needs during a health crisis.

3.Waiver of Premium Rider:

If the policyholder becomes disabled or unable to work due to illness or injury, this rider waives the premium payments for the base policy, ensuring that.

4.Income Benefit Rider:

In the event of the policyholder's death, this rider provides a regular stream of income to the beneficiary over a specified period, in addition to the death benefit from the base policy.

5.Child Education Rider:

This rider ensures that if the policyholder dies or becomes disabled, a lump sum or periodic payments are made to fund the education of the insured's children.

6.Term Rider:

This rider provides additional coverage for a specified term or period while the base policy is in effect. It can be used to increase the overall death benefit temporarily.

7.Family Income Benefit Rider:

Similar to the income benefit rider, this rider provides a regular income to the beneficiary in the event of the policyholder's death. However, it often provides a higher income for a specified duration.

8.Accidental Disability Income Rider:

This rider offers regular income to the policyholder in case of a disability caused by an accident, helping to replace lost income during the recovery period.

These are just a few examples of supplementary covers that can be added to a State Life Insurance policy or a similar life insurance policy. The availability of these riders and their specific terms and conditions can vary from one insurance company to another, so it's essential to review the policy documents and consult with an insurance agent or advisor to understand the options available and choose the ones that best suit your needs.

People who live outside the country can also contact 0092-333-5697520