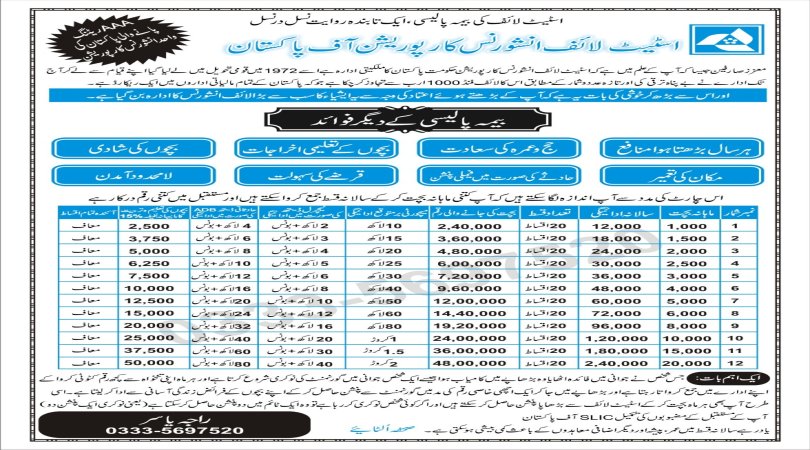

Wealth Builder plan

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

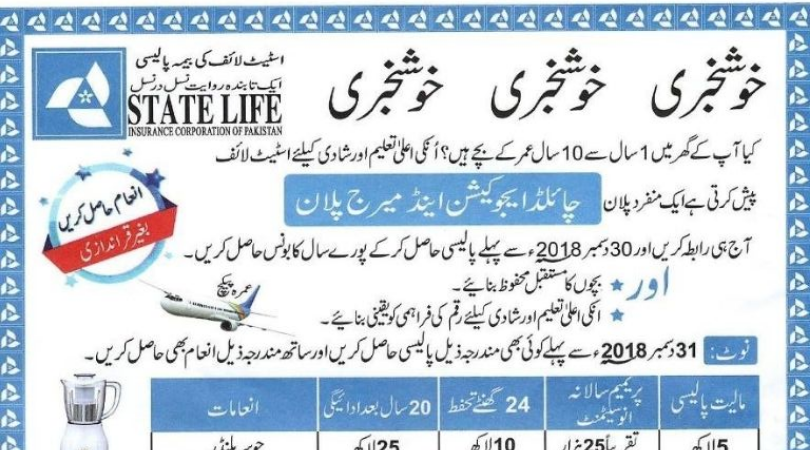

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

A "Wealth Builder Plan" is not a specific financial product or investment strategy with a universally recognized definition. Instead, it could refer to a variety of different financial plans or strategies designed to help individuals and investors build wealth over time. These plans are often associated with long-term financial goals, such as retirement savings or wealth accumulation for major life events.

Here are some common elements or features that might be associated with a "Wealth Builder Plan," but it's important to note that the specific details can vary widely depending on the financial institution, advisor, or individual's preferences:

1.Investment Strategy:

Wealth Builder Plans typically involve investment in assets such as stocks, bonds, mutual funds, real estate, or other financial instruments. The choice of investments depends on the individual's risk tolerance, time horizon, and financial goals.

2.Regular Contributions:

These plans often involve making regular contributions or investments over time. This can be done through automated deductions from your salary or bank account, ensuring consistent savings and investments.

3.Diversification:

Diversification is a key principle of many wealth-building strategies. It involves spreading investments across different asset classes to reduce risk.

4.Tax Efficiency:

Some Wealth Builder Plans may include tax-efficient strategies to minimize the impact of taxes on your investment returns, such as using tax-advantaged accounts like IRAs or 401(k)s.

5.Financial Planning:

A Wealth Builder Plan may include financial planning services to help individuals set specific financial goals, assess their risk tolerance, and develop a customized investment strategy.

6.Professional Advice:

Many individuals seek the guidance of financial advisors or investment professionals when creating and managing their Wealth Builder Plans.

7.Long-Term Perspective:

Wealth building is typically a long-term endeavor, so these plans often encourage investors to stay committed to their strategy over many years, benefiting from compound returns.

8.Risk Management:

Managing risk is an integral part of wealth building. Plans may include strategies for risk management and ways to adapt to changing financial circumstances.

9.Monitoring and Review:

Regularly reviewing and adjusting the plan as needed is important to ensure that it remains aligned with your goals and changing life circumstances.

It's crucial to note that there is no one-size-fits-all approach to wealth building, and what works best for an individual may not be suitable for someone else. When considering a Wealth Builder Plan, it's essential to consult with a qualified financial advisor or planner who can help you create a strategy tailored to your unique financial situation and goals. Additionally, it's wise to be cautious of any plan or investment that promises guaranteed or unrealistic returns, as there is no surefire way to predict future investment performance.

People who live outside the country can also contact 0092-333-5697520