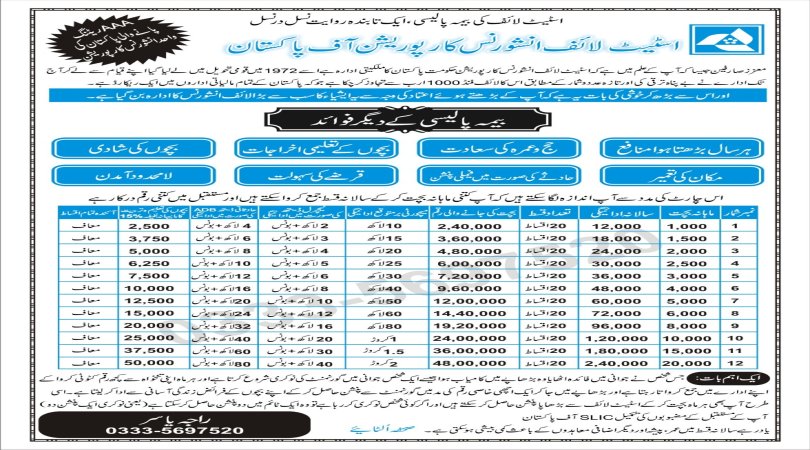

House Building & Perquisites Insurance Scheme

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

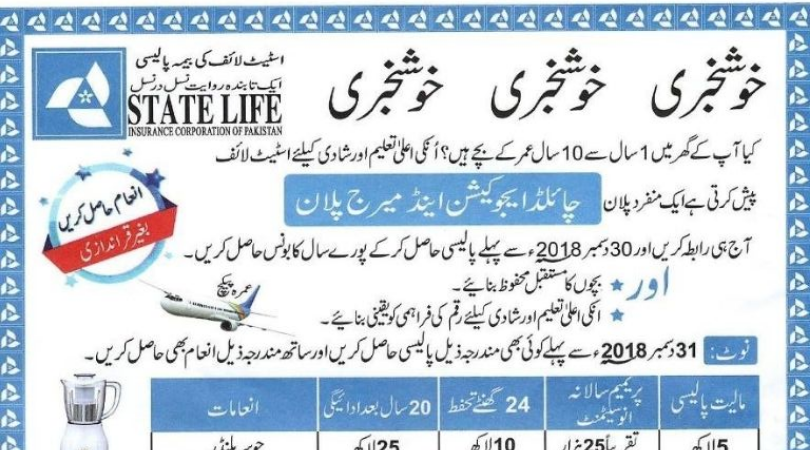

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

I'm not aware of a specific insurance scheme called the "House Building & Perquisites Insurance Scheme" as of my last knowledge update in September 2021. Insurance policies and schemes can vary widely by region and country, and new ones may have been introduced since then.

However, I can provide some general information about common types of insurance related to house building and homeownership:

1.Homeowners Insurance:

This is a standard type of insurance that provides coverage for damage to your home and its contents. It typically covers events like fire, theft, vandalism, and certain natural disasters. It may also include liability coverage in case someone is injured on your property.

2.Builder's Risk Insurance:

This type of insurance is often purchased by property owners or contractors during the construction or renovation of a building. It covers damage to the structure and materials on-site during construction.

3.Title Insurance:

This type of insurance protects homeowners and lenders from financial loss due to defects in a property's title. It ensures that the property's title is clear and that there are no ownership disputes or outstanding liens.

4.Flood Insurance:

In areas prone to flooding, homeowners may need to purchase separate flood insurance policies since standard homeowners insurance usually doesn't cover flood damage.

5.Earthquake Insurance:

Similarly, in earthquake-prone regions, homeowners may opt for earthquake insurance to cover damage caused by seismic activity.

6.Mortgage Insurance:

If you have a mortgage with a down payment of less than 20%, you may be required to purchase private mortgage insurance (PMI) to protect the lender in case you default on the loan.

7.Home Warranty:

While not insurance in the traditional sense, a home warranty is a service contract that covers the repair or replacement of major systems and appliances in a home, such as HVAC, plumbing, and kitchen appliances.

8.Liability Insurance:

In addition to homeowners insurance, some individuals may choose to purchase additional liability insurance for extra protection in case they are sued for injuries or damages that occur on their property.

Please note that insurance requirements and options can vary widely depending on your location, the type of property you own or are building, and your specific needs. It's essential to consult with an insurance agent or broker who can provide guidance based on your unique circumstances and local regulations.

People who live outside the country can also contact 0092-333-5697520