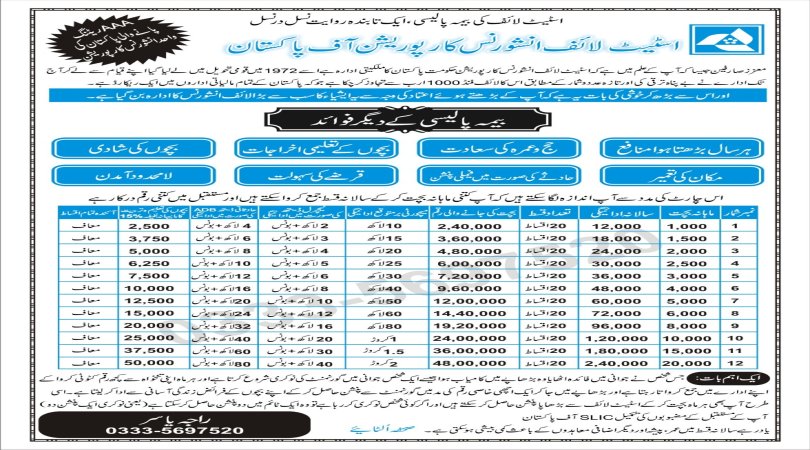

Group Endowment Insurance Scheme

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

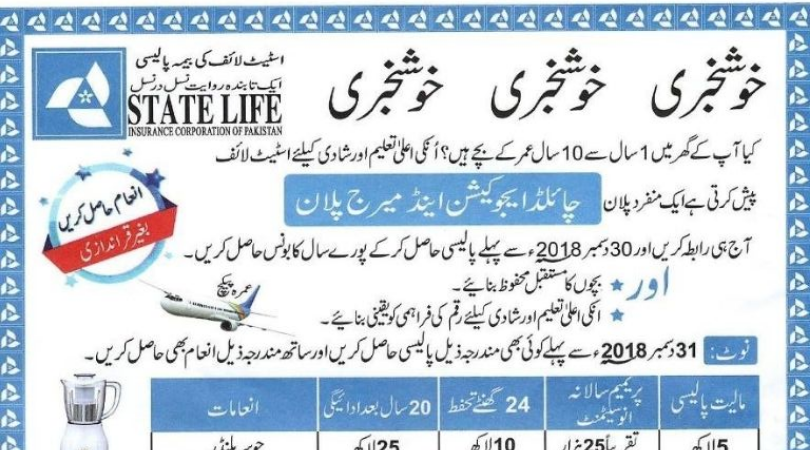

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

A Group Endowment Insurance Scheme is a type of insurance plan that is typically offered by insurance companies to groups of people, such as employees of a company, members of an association, or members of a cooperative. This insurance scheme combines elements of both endowment insurance and group insurance.

Here are some key features and aspects of a Group Endowment Insurance Scheme:

1.Group Coverage:

It provides life insurance coverage to a group of individuals who are part of the same organization or association. This group can be employees of a company, members of a professional association, or any other defined group.

2.Endowment Component:

The policy combines insurance coverage with an endowment element. This means that in addition to providing a death benefit, it also offers a savings or investment component. Over the policy term, a portion of the premium paid by the insured members is invested, and the policyholder may receive a lump sum payout (endowment) at the end of the policy term.

3.Death Benefit:

In the event of the death of an insured member during the policy term, a predetermined death benefit is paid out to the beneficiary or beneficiaries. This benefit is typically a multiple of the insured member's salary or a fixed amount specified in the policy.

4.Maturity Benefit:

If an insured member survives the policy term, they may receive the maturity benefit, which is the accumulated savings or investment component of the policy. This lump sum can be used for various purposes, such as retirement planning, education, or other financial goals.

5.Group Premiums:

The premiums for a Group Endowment Insurance Scheme are usually paid collectively by the group sponsor (e.g., the employer or association) on behalf of the insured members. Premiums may be uniform for all members or based on factors like age, salary, or other criteria.

6.Tax Benefits:

Depending on the tax laws in a particular country, contributions to group insurance schemes, as well as the benefits received, may be subject to tax advantages or exemptions.

7.Customization:

The terms and conditions of a Group Endowment Insurance Scheme can be customized to suit the needs and objectives of the sponsoring organization and its members. This may include choosing the policy term, coverage amount, and other policy parameters.

8.Group Enrollment:

Typically, all eligible members of the group are automatically enrolled in the scheme, and coverage often does not require medical underwriting or individual underwriting.

Group Endowment Insurance Schemes are designed to provide financial security and savings opportunities to the members of a group. They can serve as a valuable employee benefit for companies or as a perk for members of associations or cooperatives. The specific details of such schemes can vary significantly depending on the insurance provider and the needs of the group. It's important for both the sponsoring organization and the insured members to carefully review the terms and conditions of the policy before enrollment.

People who live outside the country can also contact 0092-333-5697520