Post Your Ad ?

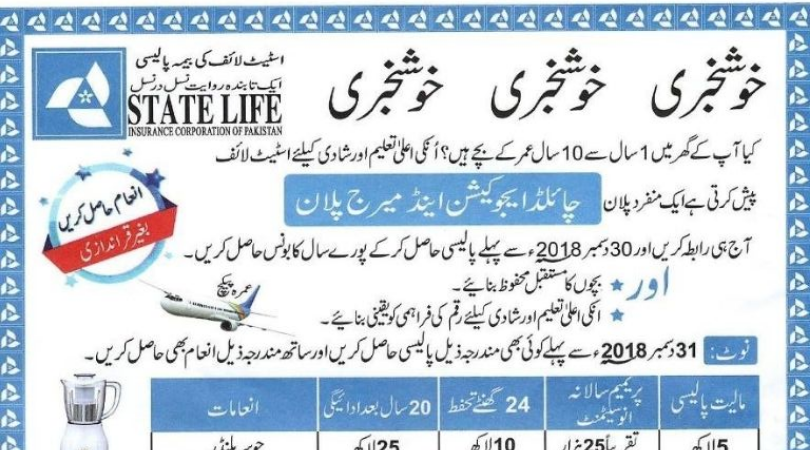

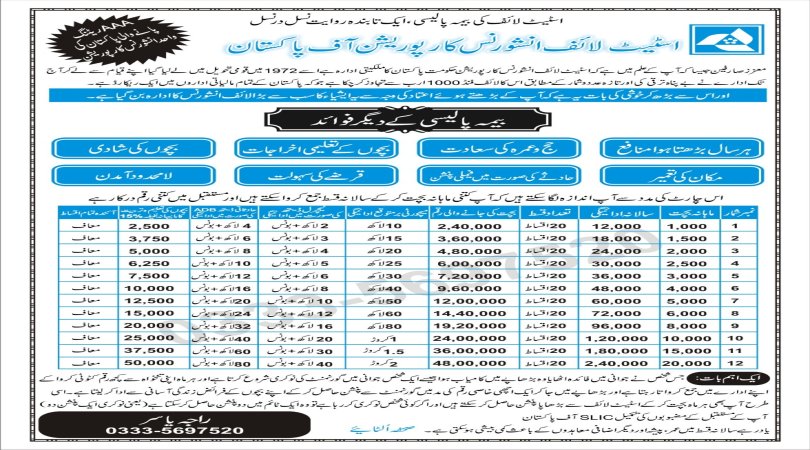

Child Education & Marriage Plan Policy Insurance

1 sep 2023, 10:00 AM

$100- 2 Bed

- 2 Bath

- UK,USA,PAKISTAN

Child Education & Marriage Plan Policy Insurance

- Whole Life Assurance

- Endowment Assurance

- Golden Endowment

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

- Child Education And Marriage Assurance

- Child Protection Assurance

- Sunheri Policy

- Shehnai Policy

- Optional Maturity Mndowment

- Nigehban

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

Child education and marriage plan policies are types of insurance policies designed to help parents save and financially prepare for their children's education and marriage expenses. These policies provide a combination of insurance coverage and investment benefits. Here's an overview of how these policies work:

Child Education Plan:

1.Objective:

The primary goal of a child education plan is to build a corpus of funds to cover the expenses related to your child's education, such as school fees, college tuition, and other related costs.2.Premium Payment:

You pay regular premiums (monthly, quarterly, or annually) for a specific tenure. The premium amount depends on the policy's terms, your child's age, and the desired sum assured (the amount you want to receive upon maturity).

3.Investment Component:

A portion of your premium is invested in various financial instruments (stocks, bonds, etc.), typically managed by the insurance company's fund managers. These investments aim to generate returns over time.4.Maturity Benefit:

When the policy matures (usually after a predefined number of years), you receive the accumulated corpus, which can be used to finance your child's education.

5.Death Benefit:

If the policyholder (parent or guardian) passes away during the policy term, the insurance company pays out a death benefit to the nominee. This benefit ensures that the child's education fund remains intact even in the absence of the policyholder.6.Riders:

You can enhance the policy by adding riders (additional coverage options) such as critical illness coverage or accidental death benefit.Child Marriage Plan:

1.Objective:

A child marriage plan is designed to accumulate funds for your child's wedding expenses. It helps parents plan for the significant costs associated with a wedding ceremony.2.Premium Payment:

Similar to a child education plan, you pay regular premiums for a specified duration. The premium amount depends on factors like the desired sum assured and the policy term.